In

Canada, federal and provincial governments raise taxes on households’ incomes

to finance their spending. These taxes are their main sources of revenue. While

the federal income tax rates are the same across the country, provincial tax

rates are different from coast to coast. As a result the tax burden on

Canadians varies depending on where they live. So do the transfers they receive.

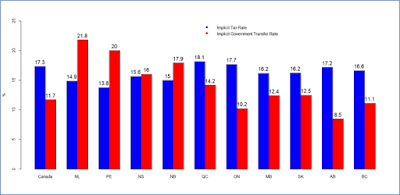

- Tax rates in Quebec and Ontario are higher than the national average.

- Tax rates in Prince Edward Island are the lowest.

- Government transfer rates are higher in the Atlantic Provinces than in the rest of Canada.

- Income redistribution is less important in Ontario, Alberta, and British Columbia.

The high rate of unemployment in the Atlantic Provinces [here]

and the low living standard [here]

explain why their tax rates are the lowest and their government transfer rates

the highest.

Focusing on Quebec and Ontario

reveals some differences between the two provinces.

|

| Implicit Tax and Government Transfer Rates by Income Quintiles, Quebec and Ontario, Averages, 1976-2011 |

- Quebec taxes high incomes higher than Ontario.

- The transfer rates to low and middle income households are, at the same time, higher in Quebec than in Ontario.

The data and R codes used are available here.

No comments:

Post a Comment